2024 Benefits at a Glance

Medical Plans

Summary of Benefits and Coverage

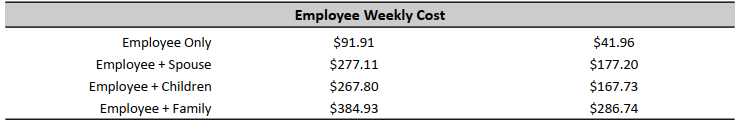

Employee Contributions

Eligibility

Eligibility

Contact Information

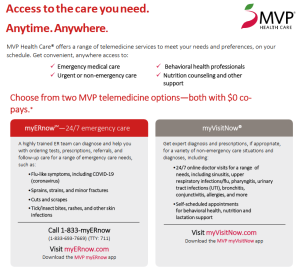

MVP myVisitNow Customer Support

1-855-696-9557

MVP myERNow Customer Support

1-833-myERnow

Download the App today!

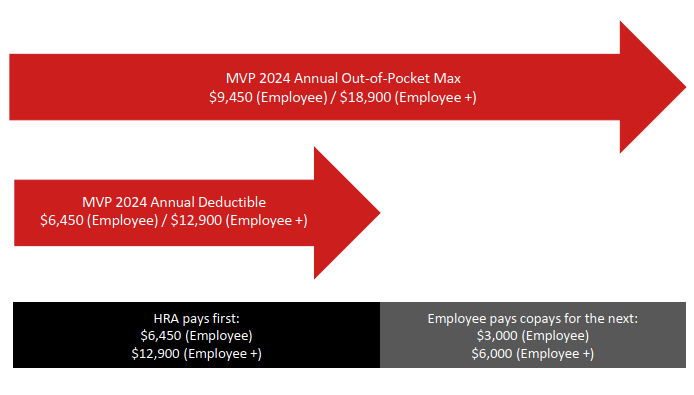

My HRA

HRA

Benoit will contribute to a Health Reimbursement Account (HRA), administered by MVP Health Care, which employees may use to help pay for deductibles and coinsurance expenses. Claims will automatically be processed and debit card will be sent to employees on the High Plan to use for prescriptions. The HRA pays first and employee pays second.

Contributions

HRA Contributions are made entirely by Benoit Electric. The annual reimbursement depends on an employee’s enrollment in an individual or family tier in Standard Bronze 2 Plan.

Eligibility

Employees enrolled in the Non-Standard Bronze Medical Plan through Benoit Electric are automatically enrolled in the HRA at no additional cost to the employee.

Contact Information

Member Portal

Download the App today!

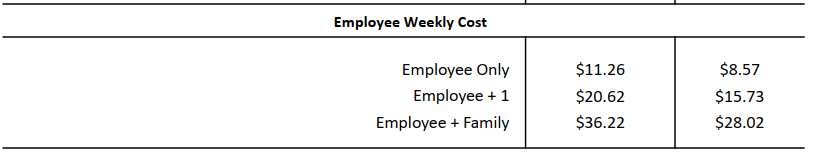

Voluntary Dental Insurance

Dental Plans

Benoit is excited to offer two voluntary (employee paid) dental insurance options to all eligible employees. These plans are offered through Northeast Delta Dental and use the PPO plus Premier Network.

Outline of Coverage

Employee Contributions

Eligibility

Employees who work at least thirty (30) hours per week are eligible for coverage on the first of the month following 90 days.

Group Life and Accidental Death and Dismemberment

Life and AD&D

Benoit Electric provides Basic Life and Accidental Death and Dismemberment (AD&D) insurance. Life insurance is designed to provide financial protection for you and your family if you were to pass on or become seriously injured while you are employed at Benoit Electric. The following Life and AD&D benefits are provided to you at no cost:

- Basic Life Insurance – $20,000 (Benefit reduction- benefit is reduced to 65% at age 70; and 50% at age 75)

- Accidental Death and Dismemberment (AD&D) Insurance – $20,000

Eligibility

Employees are automatically enrolled following 1 year after date of hire.

Group Disability Insurance

Long Term Disability

Benoit offers a Long Term Disability policy which provides you with financial protection by paying a portion of your income (monthly) while you are disabled. This benefit is 100% paid by Benoit.

Short Term Disability

Benoit also offers a Short Term Disability policy which provides you with financial protection by paying a portion of your income (weekly) while you are disabled. This benefit is 100% paid by Benoit.

Eligibility

Along with Group Life/AD&D, all employees are automatically enrolled in Short Term and Long Term Disability following 1 year of employment.

Voluntary Life and Accidental Death & Dismemberment Benefits

Voluntary Life and Accidental Death and Dismemberment Insurance

Voluntary Employee Life

Eligible employees may purchase Voluntary Term Life and Accidental Death and Dismemberment Insurance coverage on themselves and their eligible dependents.

Voluntary Life Insurance is 100% employee funded. Premiums are determined by the amount of coverage elected and the age of the employee. Premiums are payroll deducted on a post-tax basis.

The minimum amount of insurance that an employee can elect is $10,000 and the maximum is 5x your annual salary up to $500,000 (subject to age and evidence of insurability requirements). Coverage can be elected in increments of $10,000. If you elect over $70,000, you will be required to fill out an Evidence of Insurability Form during initial eligibility; after initial eligibility all benefit amounts require an EOI.

Voluntary Spousal Life

Your spouse is eligible to elect $10,000 up to $500,000 (but no more than 50% of your election).

Your spouse has a Guarantee issue of $10,000.

Voluntary Dependent Child Life

The amount of insurance available for eligible dependent children is $2,500 to $10,000. Benefit Amount cannot exceed 100% of the employee’s benefit amount.

Voluntary AD&D

The Accidental Death and Dismemberment benefit is equal to the elected Life Insurance Benefit and included in your overall rate. Your dependents can also be covered. This benefit is paid, in addition to the life benefit, if you or a covered dependent dies in a covered accident. It also pays if you suffer a covered dismemberment.

Contributions

100% Employee Paid. Rates are based on age.

Eligibility

Employees budgeted to work 30 or more hours per week are eligible to enroll. New hires may enroll after the first of the month following 90 days of employment. There will be an annual Open Enrollment period in which all eligible employees may enroll (if not initial open enrollment, you may be subject to an Evidence of Insurability Questionnaire.

Voluntary Accident & Critical Illness

Voluntary Accident Insurance

Employees can purchase accident insurance through Reliance Standard. If an employee or covered dependent seeks medical care resulting from an accident, they are eligible to be paid out a dollar amount based on what care is received. Cost and more details are located in the summary linked above.

Voluntary Critical Illness

Employees can purchase critical illness insurance through Reliance Standard. If an employee or covered dependent is diagnosed with a critical illness they are paid out a dollar amount between $5,000 and $10,000. Cost and more details are located in the summary linked above.

Contributions

100% Employee Paid. Rates are based on age.

Eligibility

Employees budgeted to work 30 or more hours per week are eligible to enroll. New hires may enroll after the first of the month following 90 days of employment. There will be an annual Open Enrollment period in which all eligible employees may enroll (if not initial open enrollment, you may be subject to an Evidence of Insurability Questionnaire.

Forms

Voluntary Accident Insurance

Voluntary Critical Illness Insurance

GradFin: Student Loan Repayment Assistance

EXCITING NEW BENEFIT FOR EMPLOYEES!

The Benoit Electric tuition assistance program is designed to help Benoit employees pay back student loan debt and improve their financial well-being.

Utilizing Benoit’s relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefit program that is revolutionizing the way employees can reduce their student loan debt.

GradFIN will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

For more information or to schedule a one-on-one consultation visit:

The Richards Group

Eligibility

In order to participate in the plan, you must satisfy certain age and service conditions under the plan:

1. Minimum age requirement: In order to participate in the plan, you must be at age 21.

Contact Information

Phone: (844) GRADFIN

For more information or to schedule a 15-minute appointment with a GradFin Consultation Expert click HERE!

Phone: (844) GRADFIN

Benefit Forms

SmartConnect - Medicare Resource

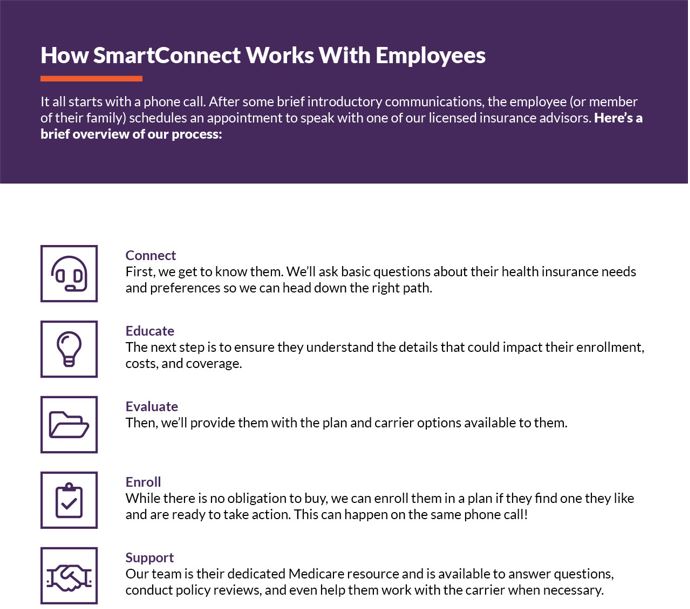

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

SmartConnect Contact Information

For more information or to get started, please click on the following link:

Additional Information