2025 Benefits at a Glance

Medical Plans

Medical Plans

Summary of Benefits and Coverage

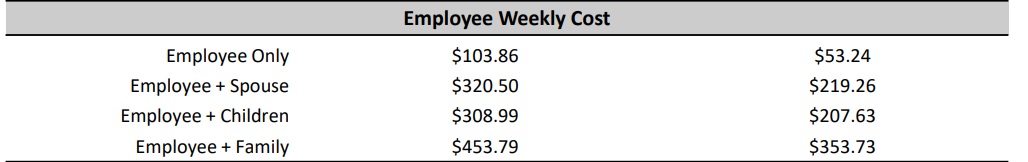

Employee Contributions

Eligibility

benefits 90 days following date of hire, after a qualified life event, or annually during the open enrollment period.

Forms

Discount Programs for Weight Loss

Through Gia, you can access virtual care services including:

- 24/7 Emergency Care

- 24/7 Urgent Care

- Mental Health and Psychiatry

- Primary Care

- Lactation Consultants

- Nutritionists and Dieticians

- NEW! Virtual Physical Therapy!

Eligibility

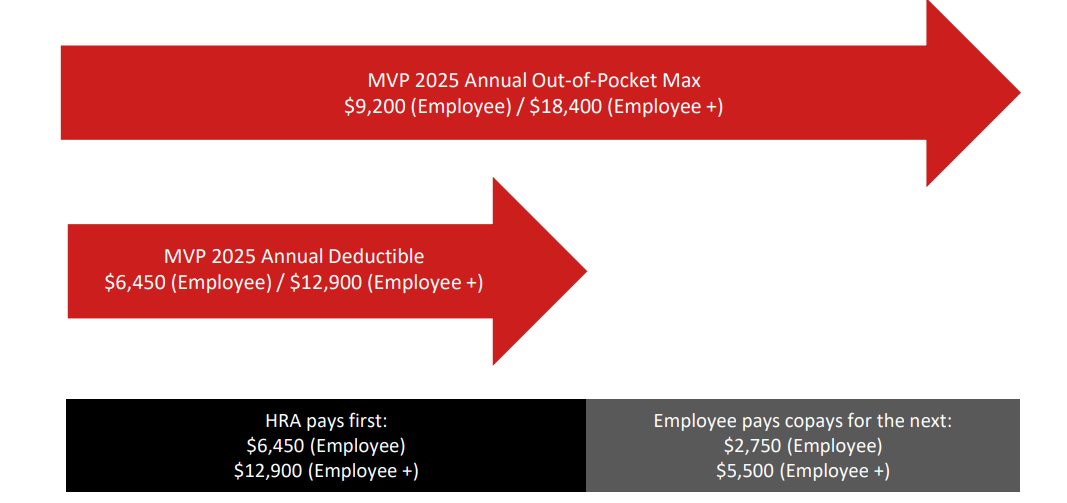

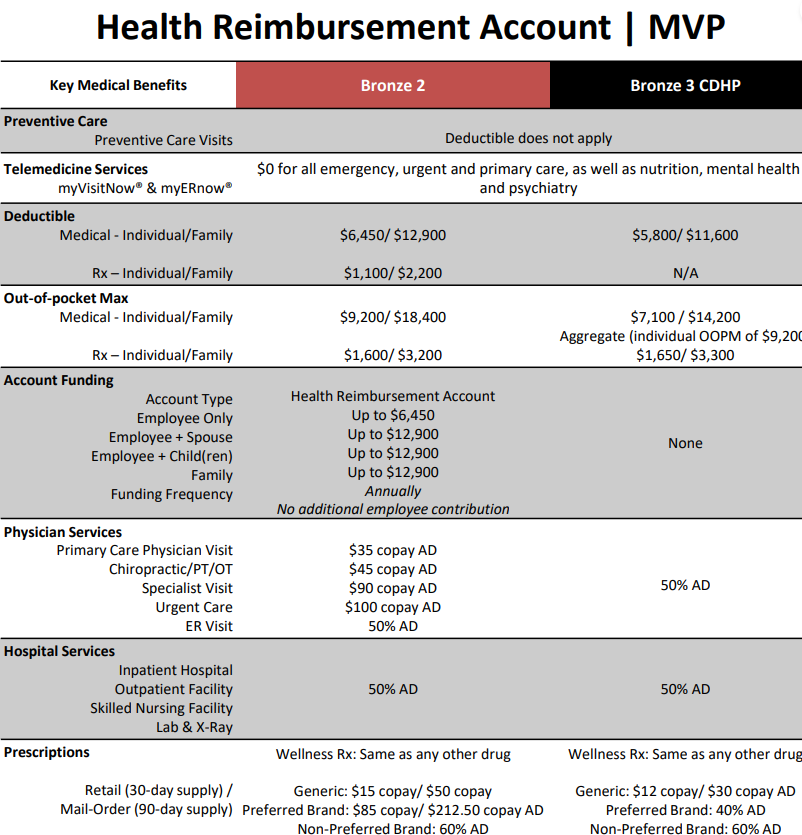

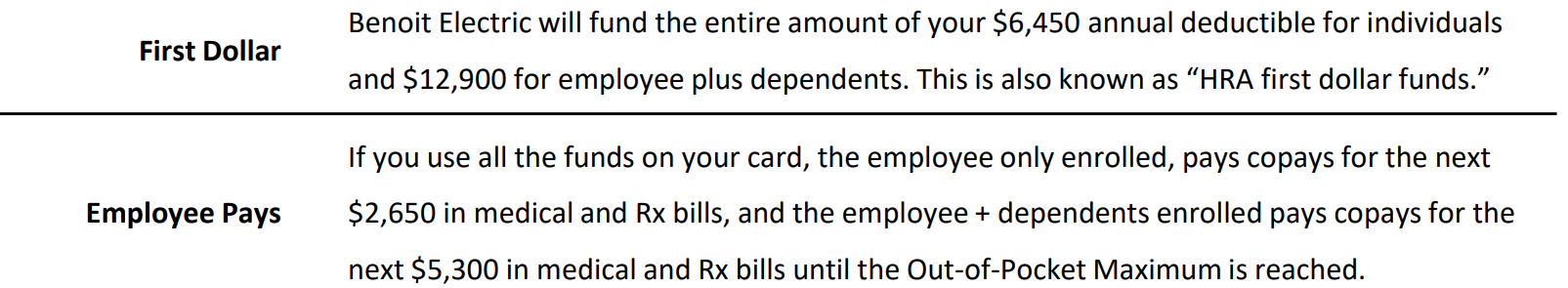

My HRA

Health Reimbursement Account

The Bronze 2 Medical plan option offers a Health Reimbursement Account (HRA) which allows you to use funds to pay for your deductible and copay expenses. Can only be used for medical and prescription costs that are applied towards your medical deductible; you can’t use the HRA for dental or vision expenses.

Curious what your FSA/HRA dollars can cover? Simply enter the product you are looking for in the eligibility list below

Contact Information

Member Portal

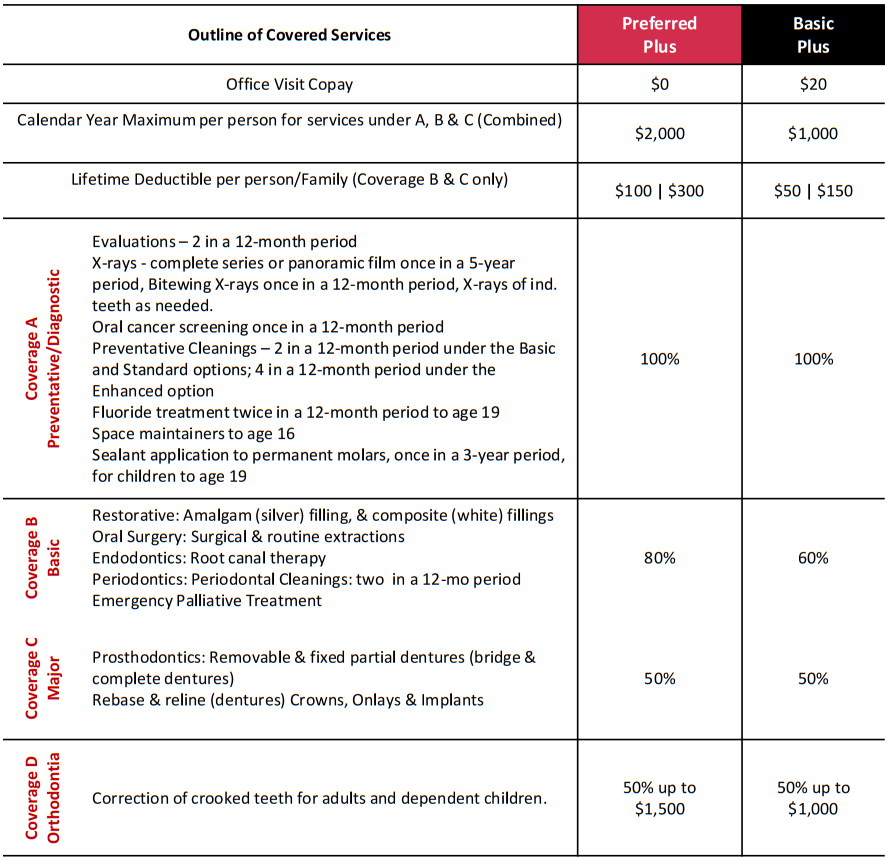

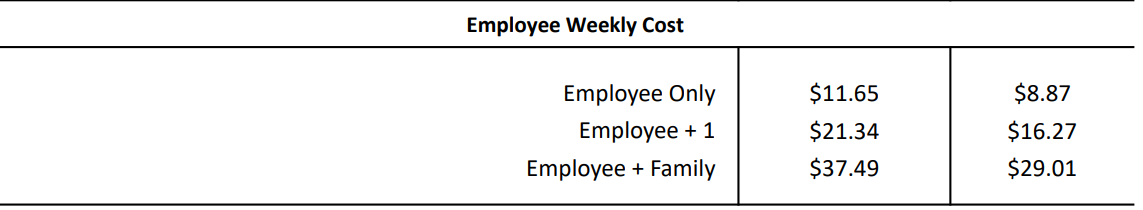

Voluntary Dental Insurance

Dental Plans

Benoit Electric is pleased to offer you a choice between two dental plans through Delta Dental’s Nationwide Network.

Employee Contributions

Eligibility

Employees who work at least thirty (30) hours per week are eligible for coverage on the first of the month following 90 days.

Group Life and Accidental Death and Dismemberment

Life and AD&D

Benoit Electric provides Basic Life and Accidental Death and Dismemberment (AD&D) insurance. Life insurance is designed to provide financial protection for you and your family if you were to pass on or become seriously injured while you are employed at Benoit Electric. The following Life and AD&D benefits are provided to you at no cost:

- Basic Life Insurance – $20,000 (Benefit reduction- benefit is reduced to 65% at age 70; and 50% at age 75)

- Accidental Death and Dismemberment (AD&D) Insurance – $20,000

Eligibility

Employees working 40 hours per week are automatically enrolled in Group Life/AD&D benefits following 1 year of continuous employment.

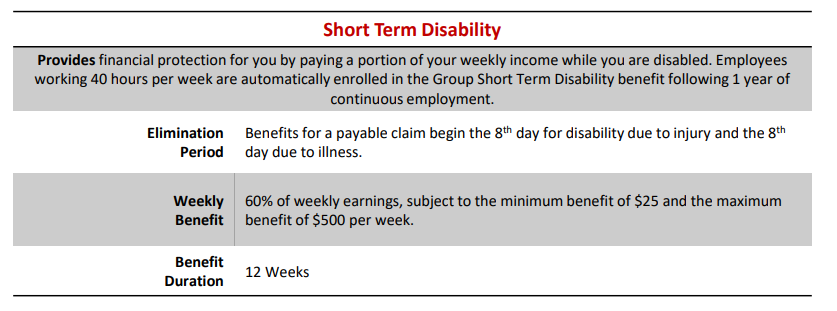

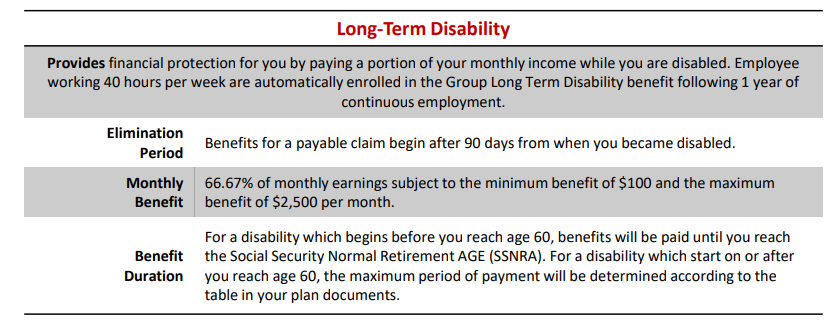

Group Disability Insurance

Short Term Disability

Benoit also offers a Short Term Disability policy which provides you with financial protection by paying a portion of your income (weekly) while you are disabled. This benefit is 100% paid by Benoit.

Long Term Disability

Benoit offers a Long Term Disability policy which provides you with financial protection by paying a portion of your income (monthly) while you are disabled. This benefit is 100% paid by Benoit.

Eligibility

Employees working 40 hours per week are automatically enrolled in the Group Short Term/Long Term Disability benefit following 1 year of continuous employment.

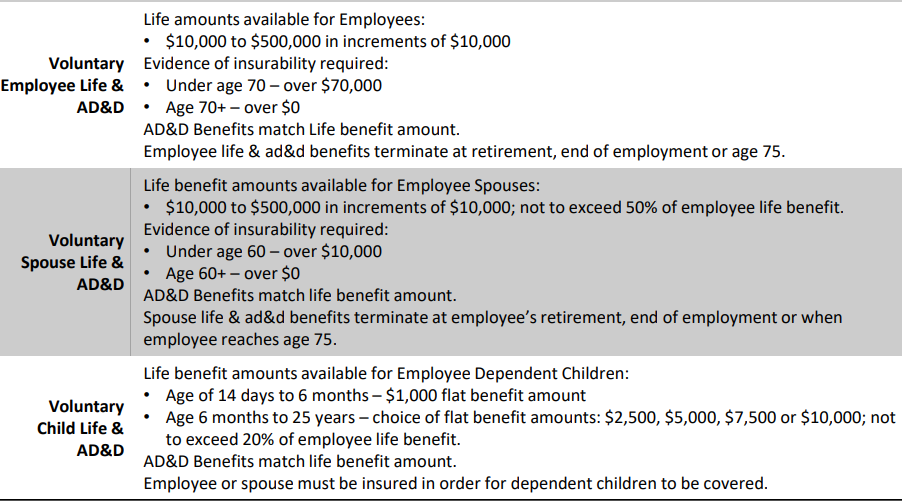

Voluntary Life and Accidental Death & Dismemberment Benefits

Contributions

100% Employee Paid. Rates are based on age.

Eligibility

Employees working 30+ hours per week, except any person working on a temporary or seasonal basis are eligible to enroll in Voluntary Life & Accidental Death and Dismemberment benefits following 90 days of continuous employment. This benefit is voluntary, and employees pay to full cost for this benefit

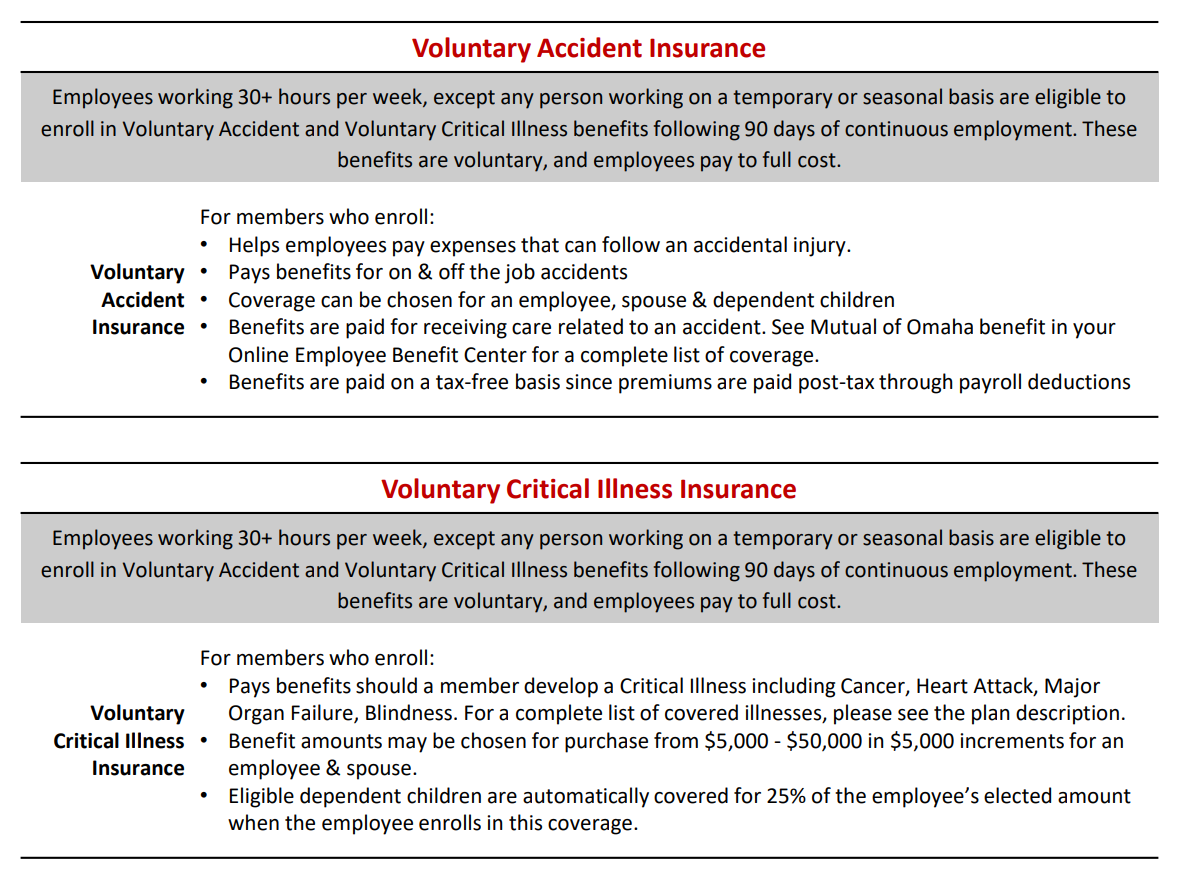

Voluntary Accident & Critical Illness

Contributions

100% Employee Paid. Rates are based on age.

Eligibility

Employees budgeted to work 30 or more hours per week are eligible to enroll. New hires may enroll after the first of the month following 90 days of employment. There will be an annual Open Enrollment period in which all eligible employees may enroll (if not initial open enrollment, you may be subject to an Evidence of Insurability Questionnaire.

Contact Information

www.mutualofomaha.com

GradFin: Student Loan Repayment Assistance

EXCITING NEW BENEFIT FOR EMPLOYEES!

Benoit Electric’s tuition assistance program is designed to help employees pay back student loan debt and improve their financial well-being. Consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefit program that is revolutionizing the way employees can reduce their student loan debt.

GradFIN will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

For more information or to schedule a one-on-one consultation visit:

The Richards Group

Eligibility

In order to participate in the plan, you must satisfy certain age and service conditions under the plan:

1. Minimum age requirement: In order to participate in the plan, you must be at age 21.

Contact Information

Phone: (844) GRADFIN

For more information or to schedule a 15-minute appointment with a GradFin Consultation Expert click HERE!

Phone: (844) GRADFIN

Benefit Forms

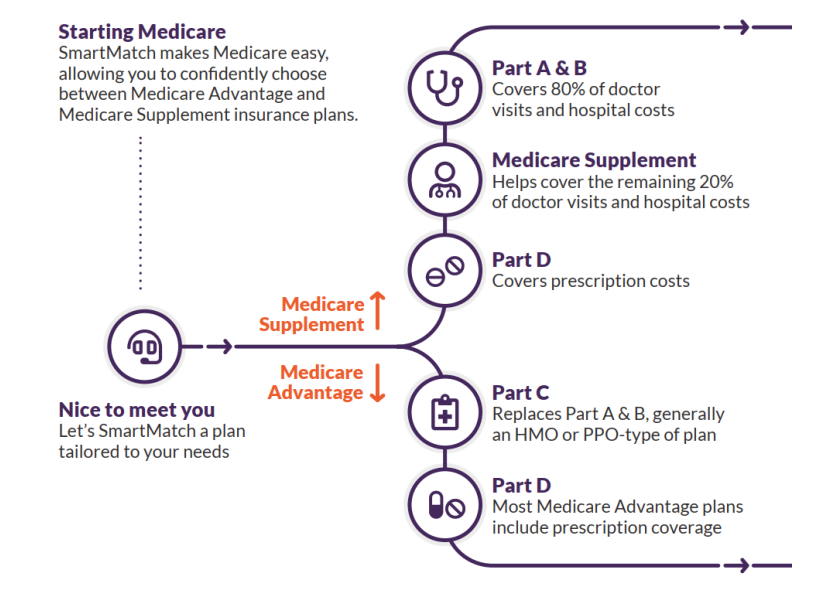

SmartConnect – Medicare Resource

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

SmartConnect Contact Information

For more information or to get started, please click on the following link:

SmartMatch Insurance

1-833-502-2747 | TTY: 711

Additional Information

Pin Paws – Pet Insurance

Health Coverage For Your Furriest Family Members

- Coverage for Cats and Dogs of All Ages and Breeds

- No Initial Exam/Past Vet Notes Required

- Accident Coverage Starts at Midnight

- Customizable and Out-of-Pocket Max

- Annual Max Payouts as Opposed to Per Incident

- Choose Your Reimbursement Percentage

- Multiple Value-Added Benefits Included

- Routine Care Option Available with Customized Plans

- Available in all 50 States!

How Does Pet Insurance Work?