Benefits: 09/2018-08/2019

We strive to reward our employees for their outstanding work, and offer benefits to promote their professional, personal, and financial well-being.

Medical Plans

Plan Options

Benoit Electric is proud to offer two plan options to all benefit eligible employees for 2018-2019. The High Plan contains a Health Reimbursement Account (HRA) while the Low Plan does not.

High Plan Overview

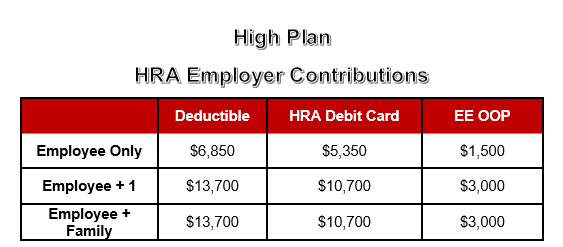

The High Plan has an individual deductible of $6,850 and a +1/family deductible of $13,700. On the High Plan, Benoit contributes to a Health Reimbursement Account (HRA) that will pay towards the plan’s deductible. Benoit will cover the first $5,350 of the individual deductible and $10,700 of the +1 and Family deductible. The employee is responsible for the remaining $1,500 on the individual plan or $3,000 on the +1 or family plan.

The HRA for the High Plan will be administered by Health Equity. Claims will automatically be processed and a card will be sent to employees on this plan to use for prescriptions.

Low Plan Overview

The Low Plan has an individual deductible of $6,400 and a +1/family deductible of $12,800 with no HRA contribution. The employee is responsible for the entire out of pocket expense.

*Please note all deductibles run from September 1, 2017 to August 31, 2018.

Eligibility

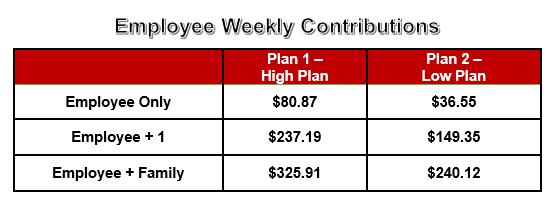

Employee Contributions

Help Center

|

Blue Cross and Blue Shield of VT Customer Service Available Monday-Friday, 7AM to 6PM (800) 247-2583 |

Plan Highlights

Medical High Plan Highlights

Medical Low Plan Highlights

Voluntary Dental Insurance

|

Benoit is excited to offer two voluntary (employee paid) dental insurance options to all eligible employees. These plans are offered through Northeast Delta Dental and use the PPO plus Premier Network. Eligibility Employees who work at least thirty (30) hours per week are eligible for coverage on the first of the month following 90 days. *Both Dental Options come with additional benefits at no extra charge! |

Dental Option 1: Basic Plus*

Dental Option 2: Preferred Plus*

If enrollees use a dentist and have less than $500 in total paid claims in a calendar year, they can carry over up to $250 for the next calendar year.

The HOW program allows for enrollees to receive extra preventative benefits including extra cleaning, fluoride treatments, sealants and periodontal maintenance, if they are at a higher risk for oral disease such as tooth decay and/or gum disease. A dentist completes a risk assessment and may or may not qualify individuals to receive these free extra benefits.

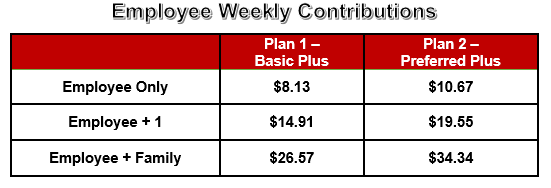

Dental Rates

Help Center

|

Delta Dental Phone: (800) 832-5700

Monday-Friday 8:00 am – 4:45 pm EST

Register as a Member to:

|

Benefit Forms

My Health Reimbursement Account

|

If you are eligible and choose to enroll in the Medical High Plan through Blue Cross Blue Shield of VT, Benoit will contribute to a Health Reimbursement Account (HRA), administered through Health Equity, which you may use to help pay for deductibles and coinsurance expenses. Claims will automatically be processed and debit card will be sent to employees on the High Plan to use for prescriptions. The HRA pays first and employee pays second. |

Help Center

|

|

High Plan HRA Employee Contributions

The following table shows the amount that Benoit will contribute each year.

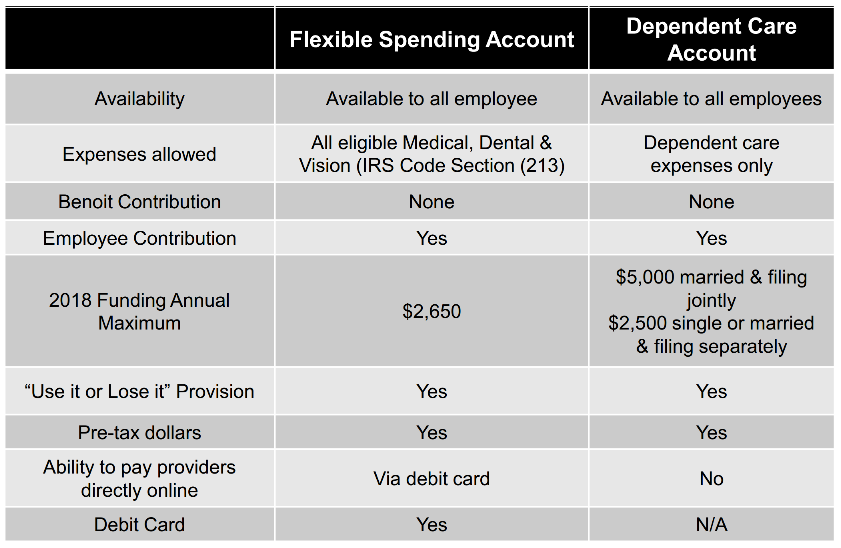

FSA & DCA Guidelines

Group Disability Insurance

Benoit offers a Long Term Disability policy which provides you with financial protection by paying a portion of your income (monthly) while you are disabled. This benefit is 100% paid by Benoit.

Benoit also offers a Short Term Disability policy which provides you with financial protection by paying a portion of your income (weekly) while you are disabled. This benefit is 100% paid by Benoit.

Help Center

|

|

Basic Life and Accidental Death and Dismemberment

Benoit Electric provides Basic Life and Accidental Death and Dismemberment (AD&D) insurance. Employees are automatically enrolled following 1 year after date of hire. Life insurance is designed to provide financial protection for you and your family if you were to pass on or become seriously injured while you are employed at Benoit Electric. The following Life and AD&D benefits are provided to you at no cost:

- Basic Life Insurance – $10,000 (Benefit reduction- benefit is reduced to 65% at age 70; and 50% at age 75)

- Accidental Death and Dismemberment (AD&D) Insurance – $10,000

Help Center

|

|

Benefit Forms

My Life & Disability Benefits

Eligibility

Employees budgeted to work 30 or more hours per week are eligible to enroll. New hires may enroll after the first of the month following 90 days of employment. There will be an annual Open Enrollment period in which all eligible employees may enroll (if not initial open enrollment, you may be subject to an Evidence of Insurability Questionnaire.

|

Voluntary Life and Accidental Death and Dismemberment Insurance

Eligible employees may purchase Voluntary Term Life and Accidental Death and Dismemberment Insurance coverage on themselves and their eligible dependents.

Voluntary Life Insurance is 100% employee funded. Premiums are determined by the amount of coverage elected and the age of the employee. Premiums are payroll deducted on a post-tax basis.

The minimum amount of insurance that an employee can elect is $10,000 and the maximum is 5x your annual salary up to $500,000 (subject to age and evidence of insurability requirements). Coverage can be elected in increments of $10,000.

Your spouse is eligible to elect $5,000 to $50,000 (but no more than ½ of your election).

Employees are required to complete an Evidence of Insurability form for life amounts over $70,000 (Guaranteed Issue) during initial eligibility; after initial eligibility all benefit amounts require an EOI. Your spouse has a Guarantee issue of $10,000.

The amount of insurance available for eligible dependent children is $2,500 to $10,000.

The Accidental Death and Dismemberment benefit is equal to the elected Life Insurance Benefit; your dependents can also be covered. This benefit is paid, in addition to the life benefit, if you or a covered dependent dies in a covered accident. It also pays if you suffer a covered dismemberment.

Employees can purchase accident insurance through Reliance Standard. If an employee or covered dependent seeks medical care resulting from an accident, they are eligible to be paid out a dollar amount based on what care is received. Cost and more details are located in the summary linked above.

Employees can purchase critical illness insurance through Reliance Standard. If an employee or covered dependent is diagnosed with a critical illness they are paid out a dollar amount between $5,000 and $10,000. Cost and more details are located in the summary linked above.

Help Center

|

|

Contributions

100% Employee Paid.

Benefit Forms

Health Advocate Core Advocacy

|

Benoit Electric provides this service free to employees. Employees can receive assistance from Health Advocate with understanding claims, working with providers, finding appropriate providers and many other services. This service is 100% confidential. Your Personal Health Advocate can help you and your family: • Find the right doctors, hospitals and other providers Eligible Employees All employees enrolled in a medical plan with are eligible to utilize Health Advocate services. |

Benefit Forms

Help Center

|

|

GradFin: Student Loan Repayment Assistance

EXCITING NEW BENEFIT FOR EMPLOYEES!

The Benoit Electric tuition assistance program is designed to help Benoit employees pay back student loan debt and improve their financial well-being.

Utilizing Benoit’s relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefit program that is revolutionizing the way employees can reduce their student loan debt.

GradFIN will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will provide up to a $300 bonus to you when you refinance your loans with GradFin. The $300 bonus will be applied to the principal balance of the closed loan.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

For more information or to schedule a one-on-one consultation visit:

Eligibility

In order to participate in the plan, you must satisfy certain age and service conditions under the plan:

1. Minimum age requirement: In order to participate in the plan, you must be at age 21.

Help Center

GradFIN

For more information or to schedule a 15-minute appointment with a GradFin Consultation Expert click HERE!

Phone: (844) GRADFIN